You can use kilometre rates to work out allowable expenses for business of a vehicle. 15052017 If you are a W2 employee who drives to deliver food you may still be able to claim a mileage deduction.

Filing Grubhub 1099 Taxes Made Easy A Guide For Independent Contractors

Filing Grubhub 1099 Taxes Made Easy A Guide For Independent Contractors

I want Grubhub to start taking taxes out of my check.

Can you claim mileage on taxes for grubhub. You can write 35 of those miles off on your taxes. Note your 401 k employee contribution limit applies for all of your 401 ks combined not per job. Careful--you cant deduct both mileage and gas at the same time.

If you require an app for your smart device that will help you track your mileage you can visit our partner. 25052021 Your increased smartphone data usage may also come with extra costs. Generally you can either take a standard deduction such as 6350 if youre filing 2017 taxes as a single person or you can list each of your deductions separately.

I didnt receive a 1099-NEC. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons. 29062020 The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed.

Business mileage for the self-employed. Use the rates for the year youre claiming. 19022021 Grubhub drivers can take a mileage write-off on their taxes at the end of the year.

Mileage related to medical appointments. 16102019 Gas and mileage expenses Deductions can lower the amount of your income thats taxablewhich reduces your total tax bill and maximizes your refund. If the 40 cents reimbursement is included on your 1099-Misc you deduct the full 535 cents allowed by the IRS.

This does not include travelling to and from your work unless its a. If youve made more than 600 last year GrubHub will send you a form 1099-NEC where you can see the money youve made on the platform. If youre making a reimbursement payment to someone the current rate applies until we provide the new rate.

Using miles to calculate your delivery fee is not the same thing as a reimbursement. I normally file taxes under a business name instead of my own. Maybe youve been busy made 20000 and over 200 transactions.

04032021 Under the new tax code you can claim a mileage deduction for. If you dont have a 401 k at work or choose not to use it you can also make your full employee contribution. Keeping track of your mileage is one of the best ways to make sure youre making the right deduction.

When you drive thousands of miles that adds up. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000. Rates per business mile.

The new NEC form is replacing the previous form 1099-MISC for non-employee compensation. 03062019 It is advised to track your mileage for your entire shift. While these job-related expenses are typically tax deductible as long as you track your mileage and keep receipts you will need to set aside room in your budget for.

28062021 It is your responsibility to track and maintain your mileage throughout the year. Everlance is a good app for tracking mileage and time. You may receive mileage reimbursement for your driving and if its below the 58 cents per mile you may be eligible for partial mileage reimbursement.

This includes miles that you drive to your first delivery pickup between deliveries and back home at the end of the day. Mileage incurred while volunteering for a nonprofit. Even if the 40 cents is not included on your 1099 the proper way to do it is still include the 40 cents as other.

Self-employed individuals can deduct their non-commuting business mileage. What do I do. How can I get a total of my mileage from last year.

Yes you can claim all those miles because that payment is NOT a reimbursement. The 1099 Team and Driver Support Team do not have access to any mileage information you may be missing. For example you tracked a total of 50 miles for your entire shift but Grubhub only paid for 15.

Every mile that you track as a contractor delivering for Doordash Uber Eats Grubhub Instacart Lyft etc is saves about 14 cents on your taxes. 21112020 Can I claim all of my miles when delivering for Grubhub when they pay by the mile. Can my 1099-NEC be issued to that business.

You may be able to claim tax relief if you use cars vans motorcycles or bicycles for work. During tax time you are entitled to whatever actual mileage you put on your car minus what Grubhub has paid for. How can I get a summary of my annual earnings from last year.

It the 40 cents is not included you deduct only the 135 cents difference. Can I still deduct these miles on my taxes. 12022020 How to Track Your Miles As a Delivery Contractor with Doordash Grubhub Uber Eats Instacart etc.

How can I make that change. 04032021 This allows you to make tax-deductible employer contributions of up to 20 of your profits. The standard mileage deduction 575 cents per mile in 2020 is calculated by the IRS to.

Free Spreadsheet For Lyft Drivers Lyft Driver Lyft Ideas Spreadsheet

Free Spreadsheet For Lyft Drivers Lyft Driver Lyft Ideas Spreadsheet

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

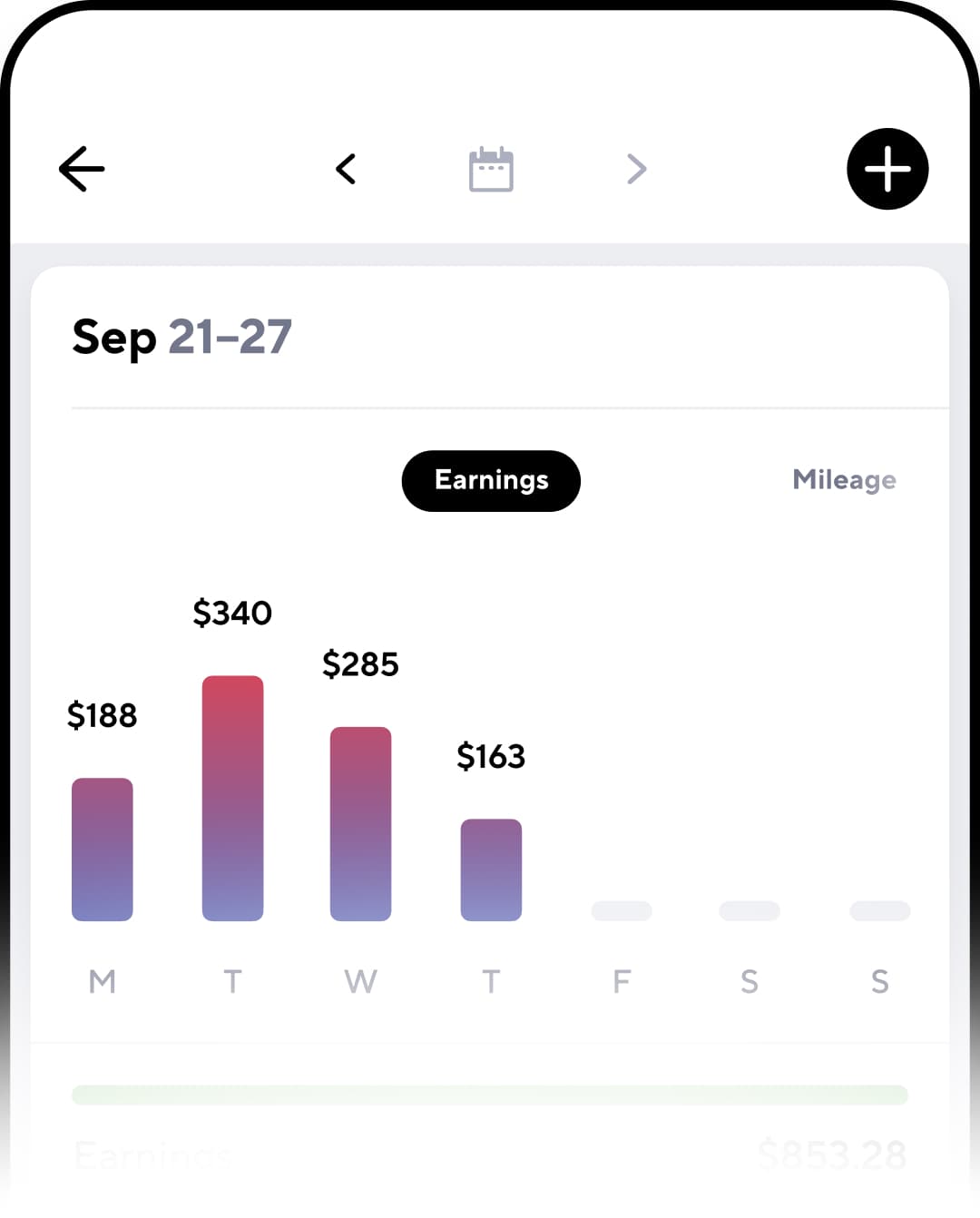

Gridwise Mileage Tracker For Food Delivery And Grubhub Drivers

Gridwise Mileage Tracker For Food Delivery And Grubhub Drivers

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Self Employment Tax Grubhub Doordash Instacart Uber Eats

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Intro To Car Expenses For Grubhub Doordash Postmates Uber Eats

Over The Past Few Months I Ve Seen A Lot Of Misinformation Being Passed Around In Regards To Rideshare Taxes I Definite Rideshare Rideshare Driver Tax Guide

Over The Past Few Months I Ve Seen A Lot Of Misinformation Being Passed Around In Regards To Rideshare Taxes I Definite Rideshare Rideshare Driver Tax Guide

Why Is Grubhub Changing To 1099 Nec Entrecourier

Why Is Grubhub Changing To 1099 Nec Entrecourier

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educational A In 2021 Doordash Mileage Tracking App Tax Guide

The Delivery Driver S Tax Information Series The Information Contained In This Information Series Is For Educational A In 2021 Doordash Mileage Tracking App Tax Guide

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Arsip Blog

-

▼

2021

(2031)

-

▼

Januari

(167)

- How Much Is A Signed Lebron James Rookie Card Worth

- Iced Peach Green Tea Starbucks Recipe

- How Much Does Charli D'amelio Make Every Tik Tok V...

- What Is Charli Net Worth

- What Is Bobby Brown's Net Worth

- How Much Is Mermaid Royalty Worth

- Ice-t Net Worth 2021

- How Much Is Toby Price Net Worth

- How Much Is 40 000 Miles Worth Alaska

- Charli D'amelio Net Worth 2020 November

- Gerwyn Price Darts Kaufen

- Denise Fitness Model

- Can We Add Lemon Juice To Green Tea

- Charli D'amelio Salary 2020

- Braydon Price New House

- Darlene Ortiz Ice T Cover

- Who Is The Richest Musician In The Whole World 2020

- How Much Is Jerry Yang Worth

- How Old Is Denise Austin Fitness Expert

- How Much Money Does Charli D'amelio Make Per Tik T...

- Ciara Wilson Net Worth 2021

- Charli D'amelio Net Worth 2021

- How Much Is Prince Charles Net Worth

- How Much Does Charli D'amelio Earn Per Tiktok

- How Much Is A Mma Belt Worth

- What Is Kelly Clarkson's Ex Husband Net Worth

- Delta Skymiles Worthless

- Siapakah Denise Cadel

- How Much Is My Mileage Worth

- How Much Did Charlie Sheen Get Paid Per Episode

- Is It Better To Get A Car With Low Mileage

- Can Nestea Make You Fat

- Who Is The Richest Musician In Nigeria 2020 Top 20

- Richest Player In The World 2020 Forbes

- Is Arizona Green Tea Better For You Than Soda

- What Is Denise Austin Worth

- Cop Killer Ice T Spotify

- Lipton Iced Tea Powder Uk

- Iced Peach Green Tea Lemonade Calories

- How Much Money Does Charli Damelio Make Off Tiktok

- Youtube Ice T Im Your Pusher

- Charlie Harper House Location

- How Many Billions Is Mike Bloomberg Worth

- How Much Money Is Fred Durst Worth

- Carey Price Net Worth 2019

- What Is Kwame Brown Net Worth

- Can You Mix Iced Tea With Milk

- How Much Is A Kobe Bryant Rookie Card Worth Now

- Who Is The Wealthiest Pro Football Player

- Who Is The Nigerian Richest Musician 2020

- Who Is The Richest Nba Player In The League Right Now

- Katie Price Net Worth Uk 2017

- Mike Brown Net Worth Bengals

- What Is Mike Brown's Net Worth

- Charles Barkley Worth

- How Much Is 70000 Miles Worth Delta

- Who Is The Top Ten Richest Musician In Nigeria 2020

- How Much Is My Kobe Bryant Rookie Card Worth

- Who Is The Most Richest Player In 2020

- Mr Price Rings Prices

- Delta Skymiles Value Calculator

- Carey Price Contract Extension

- Lipton Ice Tea Nutritional Info

- How Much Is 1 Million Air Miles Worth

- How Much Gas Mileage Does A Tonneau Cover Save

- Lipton Black Iced Tea Mix Decaf Lemon Sweetened

- How Many Calories In An Iced Matcha Green Tea Latte

- Charli Damelio Age Height

- Austin 7 Price In India

- Lipton Ice Tea Flavours Australia

- Ice Cube On Face

- Is Iced Green Tea Healthy For You

- Can You Mix Lemon Juice With Green Tea

- Iced Soy Matcha Latte Calories

- Ice T First Impression Lyrics

- Lipton Diet Iced Tea Mix Lemon Caffeine

- How Much Are Miles Worth On Taxes

- Nick Price Net Worth 2018

- Mr Price Priced To Go

- How Much Do You Get For Mileage On Taxes

- Ice T New Film

- How Much Did Drew Carey Make On The Price Is Right

- Braydon Price Honda Vs Can Am

- How Much Money Is Mike Tyson Worth Now

- A J Brown Net Worth

- How To Deduct Mileage On Taxes 2020

- Ciara Wilson Net Worth 2019

- Charley Pride How Much Is He Worth

- How Much Are Miles Worth On Credit Cards

- How Much Is Mike Wolfe American Pickers Worth

- Katie Price Net Worth 2000

- How Much Money Does Charli D'amelio Make A Tiktok ...

- How Much Is A Natural Gas Well Worth

- Can You Claim Mileage On Taxes For Grubhub

- How Much Is R Kelly House Worth

- How Much Is 60 000 Air Miles Worth

- How Much Does Charli D'amelio Make Per Video On Ti...

- Who Is The Richest Nfl Player Right Now

- How Is Toby Keith Worth So Much

- How Much Is Nick Price Worth

-

▼

Januari

(167)