You cant take a section 179 deduction or special depreciation allowance. Nov 05 2020 Every year the worth of the rate of every mile driven for work purposes is calculated by the IRS.

Best Expenses And Mileage Tracker App Notary Signing Agent Notary Public Business Notary Public

Best Expenses And Mileage Tracker App Notary Signing Agent Notary Public Business Notary Public

For example break-even would be a flight that costs 400 or.

How much is business mileage worth. Apr 16 2019 Each year the IRS sets a standard mileage deduction rate. This example shows that the business mileage expense for this month would equal 5750 in 100 0575. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes.

45 rows Jul 05 2021 With its current welcome offer youll earn an impressive 100000 bonus. In 2012 the IRS standard business mileage reimbursement rate is 555 cents per mile. Jun 03 2021 How much does Alaska Airlines think its miles are worth.

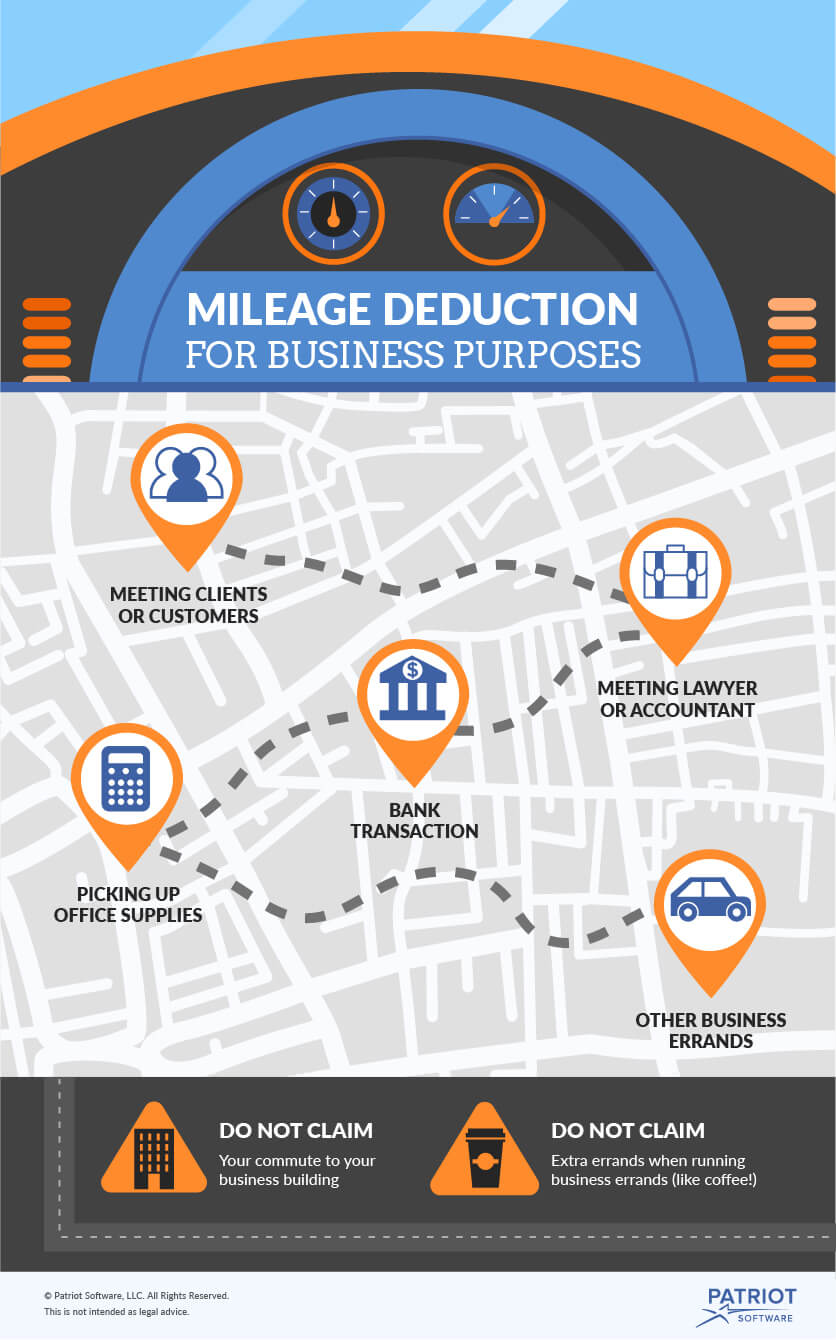

The standard price to buy miles is 2750 for 1000 miles at a cost of 275 cents per mile. For 2018 filing your taxes in 2019 the rates are. Transportation That Qualifies for Business Deduction There is no maximum for the number of miles that can be claimed for a deduction.

If you drive a lot of business miles it can be a pretty hefty addition to your standard income. Now that weve looked at the rules of the Mileage Plus program and weve looked at the. 18 cents per mile for medical purposes.

Apr 25 2012 This post is part of a four-part series. Mar 04 2021 When it comes to mileage tax deductions the self-employed mileage deduction is the largest one available. To help with those costs the standard mileage rate s let you deduct.

For this analysis Ill base my numbers on earning 60000 EQMs at a cost of 125 cents per mile so a. 14 rows Standard Mileage Rates. If you use your car 50 or less for business purposes you can still deduct standard mileage or actual costs based on your percentage use of the car for business.

Oct 12 2020 American AAdvantage miles are estimated to be worth 14 cents apiece as of August 2020 according to Bankrate sister site The Points Guy. For depreciation purposes special rules apply if you dont use your car 50 or less for business purposes. Every business mile is worth 535 cents in 2018.

Rates in cents per mile. At one point I was driving 720 miles a week for business. Value of airline miles by airline Airline miles value on international flights.

While business and first-class tickets generally cost more than economy tickets you can sometimes get a better mileage value with a higher-class ticket. In Part 4 Ill put a number on one Mileage Plus mile. American Airlines has a point redemption of 10 cent for economy tickets but almost 15 cents for business class.

A while back Travis wrote an excellent series about how to go about valuing points. So if I say a mileage currency is worth 16 cents and someone else says theyre worth 19 cents I cant really prove them wrong other than providing an explanation of where my valuation comes from. Anyone who can do basic math can quickly see that someone who does a lot of driving for business travel can get a pretty nice deduction.

The Internal Revenue Service IRS knows there are costs for using your personal vehicle for work reasons. Not directly related but I figured it was worth mentioning that Alaska Airlines regularly sells Mileage Plan miles. However the value of your American Airlines miles depends.

The value of an airline mile depends on a few factors including the airline whether you are flying international domestic economy or business and the day of the week that you are flying. Multiply business miles driven by the IRS rate To find out your business tax deduction amount multiply your. Companies is worth 13 cents.

Mar 15 2019 How Much Is My Mileage Worth. So if you drive 20000 business miles this year your mileage would be worth a 10700 deduction. Jan 31 2020 A.

In Part 1 we looked at the mechanics of the United Mileage Plus program. Apr 29 2021 The average airline mile across major US. Jan 01 2021 Everyone values redemptions differently.

In Part 3 well value specific Mileage Plus awards. Aug 29 2019 Using Miles for Business and First Class. For 2020 tax filings the self-employed can claim a 575 cent deduction per business mile.

Jul 01 2020 Because we value MileagePlus miles at an average of 1 cent each redemptions that give you at least that much value are a decent option. May 21 2012 Business Mileage Reimbursement Do You Really Make Money. Feb 21 2021 The second tier in Americans program is AAdvantage Platinum status which normally requires 50000 EQMs or 60 elite-qualifying segments plus 6000 EQDs.

Dec 22 2020 56 cents per mile driven for business use down 15 cents from the rate for 2020 16 cents per mile driven for medical or moving purposes for qualified active duty members of the Armed Forces down 1 cent from the rate for 2020 and. 545 cents per mile for business reasons. As of 2017 the rate was set at 535 cents for every business mile driven.

It could be worth a lot. The 2021 standard mileage rate is 56 cents per business mile driven. Multiply the number of business miles with the mileage rate 58 cents.

In Part 2 we looked at the chart and rules to find valuable awards.

Business Mileage Tracking Log Business Plan Template Free Business Plan Template Daycare Business Plan

Business Mileage Tracking Log Business Plan Template Free Business Plan Template Daycare Business Plan

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

![]() 25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Delta Skymiles Skyteam Award Chart 3 Mileage Chart Reward Chart Delta Airlines

Delta Skymiles Skyteam Award Chart 3 Mileage Chart Reward Chart Delta Airlines

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Business Finance Business Tips

The Epic Cheatsheet To Deductions For The Self Employed Business Tax Business Finance Business Tips

25 Printable Irs Mileage Tracking Templates Gofar

25 Printable Irs Mileage Tracking Templates Gofar

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

What Do Most Companies Pay For Mileage Reimbursement

What Do Most Companies Pay For Mileage Reimbursement

Arsip Blog

-

▼

2021

(2031)

-

▼

Mei

(350)

- How Much Does Michael Bloomberg Worth

- How Much Does Mileage Affect Car Value

- How Much Is Charlie Dimmock Worth

- What Is Kelly Clarkson's Net Worth

- How Much Is 50000 Qantas Frequent Flyer Points Worth

- What New Pokemon Cards Are Worth Money

- Katie Price How Much Is She Worth

- How Much Is Ice T Net Worth

- Fred Couples Net Worth 2018

- Does Charli Damelio Get Money From Tiktok

- Does Lipton Iced Tea Peach Have Caffeine

- Charli Xcx Net Worth 2019

- Denise Meme

- How Much Money Charlie Sheen Make Per Episode

- Is Lipton Diet Green Tea Citrus Good For Weight Loss

- How Much Money Does Tmz Staff Make

- Lipton Diet Iced Tea Lemon Caffeine

- Iced Matcha Green Tea Latte Starbucks Ingredients

- How Much Is Fred Done Worth

- Ice T From Svu

- How Much Does Charli D'amelio Make Off One Tiktok

- Top 10 Richest Musician In Nigeria 2020 Now

- Lipton Southern Sweet Tea Mix Caffeine Content

- Is It Better To Buy A Newer Car With High Mileage ...

- Ice Tea Peach Mengkudu Jrm

- Is Green Tea With Mint Good For Pregnancy

- How Much Is A Kobe Bryant Rookie Card Worth

- How Much Money Does Charli Get Paid Per Tiktok

- Does Charli Make Money From Tiktok

- Unsweetened Mint Iced Tea Recipe

- Braydon Price Truck Color

- Who Is The Richest Footballer In South Africa 2020

- Google How Much Is Charlie Sheen Worth

- Gerwyn Price Welsh Darts Player

- How To Make Astronaut Ice Cream In Little Alchemy 2

- How Do You Add Mint To Tea

- What Is Charli D'amelio's Net Worth 2020

- How Much Is 100 000 Delta Miles Worth

- Iced Green Tea Recipe Starbucks

- How Much Is An Autographed Lebron James Rookie Car...

- How Much Is Danny The Count Car Collection Worth

- Lipton Ice Tea Lemon Zero 1 5l

- Ig Denise Cadel

- How To Make Iced Chai Tea With Milk

- How Much Does Braydon Price Make On Youtube

- How Much Is Business Mileage Worth

- Happy Birthday Denise Memes

- Mcdonalds Iced Green Tea Latte

- Arizona Iced Tea Net Worth

- Iced Tea With Lemon Balm

- Is Lipton Honey Lemon Green Tea Good For Weight Loss

- How Many Calories In A Starbucks Hot Skinny Vanill...

- Royalty Brown Net Worth 2020 Forbes

- How Much Does Gas Cost For 40 Miles

- How Much Are Miles Worth United

- How Much Is 40 000 American Airlines Miles Worth

- How Much Is The Owner Of The Bengals Worth

- Ice T Rapper Real Name

- Can You Freeze Homemade Iced Tea

- How Much Is Prince Charles Of England Worth

- Who Is The Richest Basketball Player 2020

- How Much Is Mike Tyson Worth Today

- Does Nestea Have Caffeine In It

- Mr Price Current Share Price

- How Much Is Charlie Pride Worth

- How Much Is Shell Gas Worth

- Who Is The Richest Footballer In The Whole World 2020

- Lipton Iced Tea Lemonade K-cups 22 Count

- How Much Is Charli Worth

- Lipton Peach Iced Tea Calories

- How Much Is Mike Worth On Shahs Of Sunset

- How Much Does Charli Make Per Post On Tiktok

- How Much Is Quincy Brown Worth

- What Happened With Fred Price Jr

- How Much Is Destiny From Shahs Worth

- What Yugioh Cards Are Worth Money Reddit

- How Much Money Charli D'amelio Make

- Charli D'amelio Tiktok

- Who Is The Richest Musician In Nigeria 2020 Top 50

- Denise Cadel Berasal Dari Mana

- Braydon Price Can Am Outlander

- How Much Is A Giannis Rookie Card Worth

- How Much Is An Mcf Of Natural Gas Worth

- Lipton Diet Iced Tea Peach Caffeine

- How Much Does Charli Make Per Tiktok

- How Much Does Charlie Moore Make A Year

- Who Is The 2020 Richest Man In Nigeria

- How Much Money Is Charles Payne Worth

- How Much Does Iced Tea Make Per Episode On Law And...

- Can Lemon Mix With Green Tea

- Top 10 Richest Musician In Nigeria 2020 October

- Coldstream Peach Iced Tea Calories

- How Long Has Drew Carey Hosted The Price Is Right

- How Much Is Charlie De Melo Net Worth

- Ice T Artist Kehinde Wiley U.s. Period Modern Cont...

- Ice T I Care Now

- How Much Does Braydon Price Make Off Youtube

- Can You Put A Tea Bag In Cold Water

- How Much Is A Mike Tyson Signed Glove Worth

- How Much Money Does Charli D'amelio Have On Tiktok

-

▼

Mei

(350)