Step 3 Optionally enter your miles driven for moving charitable or medical purposes. LAX-SYD-AKL F 80000 miles and 14.

Pin On Prek12 Minimoguls Financial Literacy Investing Ed

Pin On Prek12 Minimoguls Financial Literacy Investing Ed

Sep 18 2019 I ran a few test searches for business class and economy class seats domestically within the US and had a hard time finding instances where Virgin Atlantic miles are worth more than 2 cents each.

How much is mileage worth on taxes. Apr 25 2012 Sign into your Mileage Plus account use the award search and find the awards youve written down. Step 1 Select your tax year. Mar 18 2017 For the medical expense deduction you cant include depreciation insurance maintenance or general repair expenses.

Jun 26 2021 For tax year 2020 the Standard Mileage rate is 575 centsmile. May 03 2018 Cents per Mile Value of Award 100 x value of award taxes. The mileage rate for the 2021 tax year is 056 per mile driven.

For the 2020 tax year the rate was 0575 per mile. Mar 04 2021 For 2020 tax filings the self-employed can claim a 575 cent deduction per business mile driven. For my awards the prices are.

Mar 26 2021 The IRS increases the standard mileage rate or mileage reimbursement rate each year to keep pace with inflation. Jun 29 2020 The mileage tax deduction rules generally allow you to claim 0575 per mile in 2020 if you are self-employed. 5000 business miles x 0575 standard rate 2875 Standard Mileage deduction.

575 cents per mile for business was 58 cents in 2019. But be sure to follow the rules and have a compliant mileage log. For the current tax year you can claim the standard mileage rate of 575 cents for every business mile driven.

Which practice should you use. Mar 17 2021 You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI. Note that your ability to claim standard deductions for moving or medical expenses may depend on your tax situation.

Uber makes it easy to track your online miles. Jul 06 2021 You cannot use the standard mileage rates if you claim vehicle depreciation. Jun 01 2017 Theres no limit to the amount of mileage you can claim on your taxes.

Instead a portion of the rate is applied equaling 27 cents-per-mile for 2020. You can deduct your mileage at the standard rate of 17 cents per mile for 2020 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. Rates in cents per mile.

The current standard mileage rate is calculated through an annual study of businesses where the fixed and variable costs of operating a vehicle for business is calculated. You can also use the standard mileage rate of 20 cents per mile for 2019 to calculate your medical mileage portion. Carrying through the example above.

Mar 29 2021 Here is a list of our partners and heres how we make money. Step 2 Enter your miles driven for business purposes. PIT-LAX E 12500 miles and 25.

For both methods you can include parking fees and tolls. Fees paid miles used miles foregone Determining the Variables in the Equation 1. For 2020 the standard mileage rates are.

Note how many miles and dollars in taxes and fees you would be charged to book that award. 12000 miles 0575 6900 Deduction under the actual expenses method. Typical values were closer to 1 or 15 cents per mile.

Mileage Reimbursement Calculator instructions. HRK-VIE-AMS-IAH-LAX E 30000 miles and 87. Apr 29 2021 For example for the following award booking with Delta Air Lines when you take the price of a basic economy fare 39820 subtract the taxes and fees 1120 and divide that amount by the number of required miles 34000 it equates to a modest value of 11 cents per mile.

Deduction under the standard mileage method Your deduction using the standard IRS rate for 2020 which was 0575 per mile would be. In 2021 the standard IRS mileage rate is 56 cents per mile for business miles driven 14 cents per mile. You may also be able to claim a tax deduction for mileage in a few other specific circumstances including if youre an armed forces reservist qualified performance artist or traveling for charity work or medical reasons.

To learn more about depreciation click here to view a list of tax forms and find Form 4562. The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of operating an automobile for business charitable medical or moving expense purposes. Jul 27 2016 Pay a road usage charge for the amount of miles they drive instead of a fuel tax The rate is 15 cents per mile Those paying mileage tax receive credit on their bills for fuel taxes they pay at gas stations Taxpayers can log miles in various ways handwritten logs GPS device or apps.

14 rows Standard Mileage Rates. What Mileage is Tax Deductible.

Business Mileage Tracking Log Business Plan Template Free Business Plan Template Daycare Business Plan

Business Mileage Tracking Log Business Plan Template Free Business Plan Template Daycare Business Plan

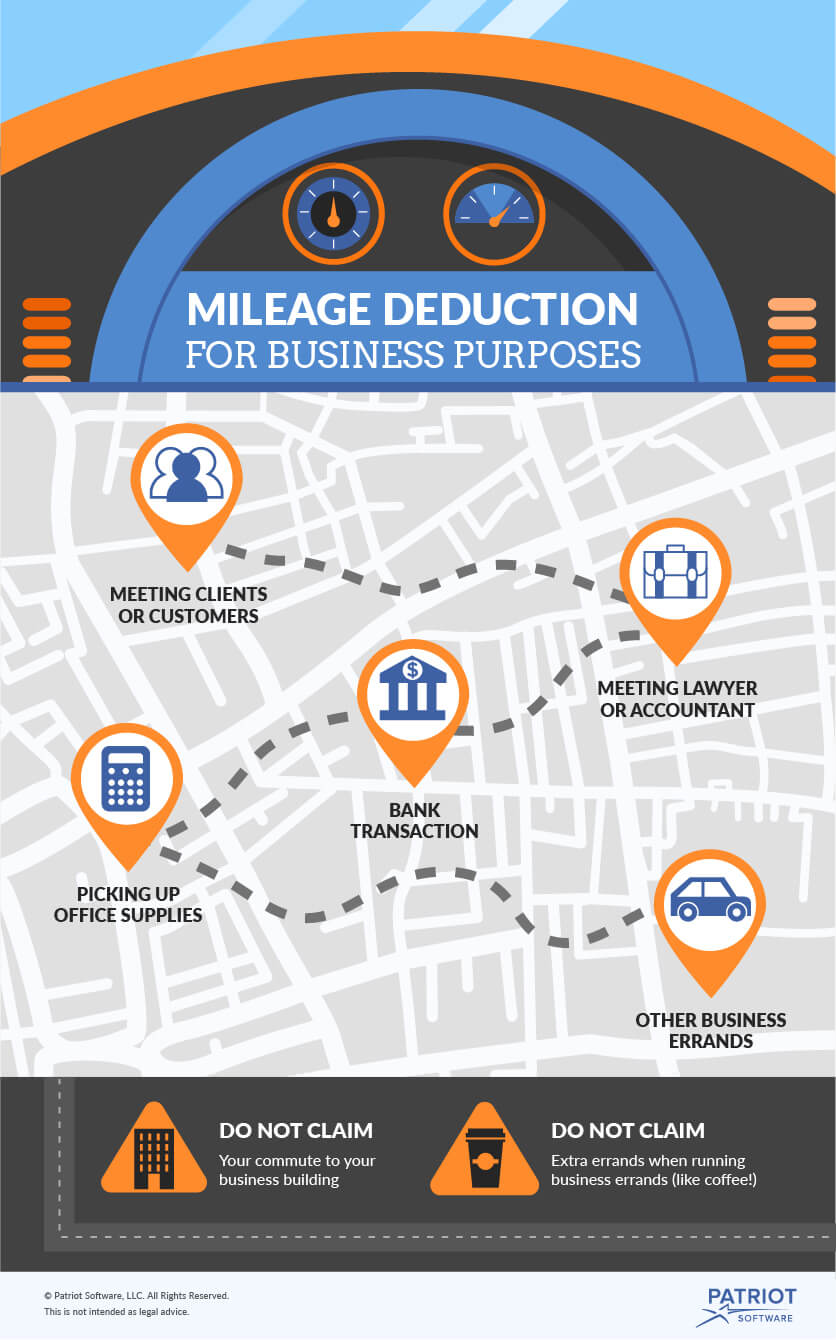

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

Business Mileage Deduction 101 How To Calculate Mileage For Taxes

You Ll Never Forget To Use This Simple Mileage Log Money Saving Tips Ways To Save Money Saving Tips

You Ll Never Forget To Use This Simple Mileage Log Money Saving Tips Ways To Save Money Saving Tips

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Templates Mileage Wedding Program Template Free

Mileage Log Template For Taxes Luxury Vehicle Mileage Log James Orr Real Estate Services Templates Mileage Wedding Program Template Free

Home Based Business License Nevada Via Home Business Tax Rules In Small Business Invest Small Business Tax Deductions Small Business Finance Small Business Tax

Home Based Business License Nevada Via Home Business Tax Rules In Small Business Invest Small Business Tax Deductions Small Business Finance Small Business Tax

What Are The Irs Mileage Log Requirements The Motley Fool

What Are The Irs Mileage Log Requirements The Motley Fool

2021 Mileage Reimbursement Calculator

2021 Mileage Reimbursement Calculator

Arsip Blog

-

▼

2021

(2031)

-

▼

Juni

(350)

- Foto Lama Denise Cadel

- Lipton Ice Tea Lemon Calories

- How Much Is Kelly Clarkson Worth Now

- How Much Is Roli From Counts Kustoms Worth

- How Much Gas Mileage Do Jeep Wranglers Get

- Lipton Ice Tea Peach Kalorien

- How Much Miles Per Gallon Does A Jeep Wrangler Get

- What Is Katie Price Net Worth 2021

- How Much Is Charles Worth

- Antonio Brown Net Worth 2019 Forbes

- Is It Good To Buy A Car With Low Mileage

- How Much Is Kelly Rowland Husband Worth

- How Much Is Mileage Worth On Taxes

- Ice Tea Green Aanbieding Blikjes

- How To Make Moroccan Mint Tea Latte

- How Much Is Prince Charles Worth

- How Much Is Nick Park Worth

- Braydon Price Net Worth 2020

- Ice-t Parents Photos

- How Much Is Nema From Shahs Of Sunset Worth

- How Much Is Charles Payne Worth On Fox News

- How Much Are My Capital One Venture Miles Worth

- How To Make Iced Tea With Fresh Mint

- How Many Girlfriends Did Charlie Harper Have

- What Happened To Drew Carey On The Price Is Right

- How Much Is 50000 Miles Worth

- Does Wawa Diet Iced Tea Have Caffeine

- Where Is Charlie Harper's House In Malibu

- How Much Do They Earn At Mr Price

- Denise Cadel

- How Much Money Is Jerry Hall Worth

- How To Add Mint To Sun Tea

- Can I Add Lemon And Honey To Green Tea

- Can We Add Lemon In Green Tea

- Ice T And Coco Baby

- How Much Money Did Charlie Harper Make

- How Much Is 40000 Air Miles Worth

- How Much Money Does Charli Earn Per Tiktok

- How Much Is 50000 Qantas Points Worth

- How To Make Iced Tea With Tea Bags And Cold Water

- Who Is Charli D'amelio In Stardog And Turbocat

- How Much Money Does Charli Make Per Tiktok

- How Much Are Capital One Walmart Rewards Points Worth

- Can Mileage Be Claimed On 2020 Taxes

- Who Is The Most Richest Footballer 2020

- Peach Iced Tea Calories Starbucks

- How Old Is Charlie Dimmock Married

- What Is Booger Brown's Net Worth

- Ice T Salary Per Episode 2017

- Nestea Iced Tea Powder Price Philippines

- How Much Is A Kobe Bryant Rookie Card Worth Today

- How To Make Costa Peach Iced Tea At Home

- How Much Is A Wayne Gretzky Rookie Card Worth

- What 1996 Yugioh Cards Are Worth Money

- How Much Is Drew Carey's Salary On The Price Is Right

- How Much Gas Mileage Does A Jeep Wrangler Get

- How Much Is Gas Mileage Worth

- Who Is The Most Richest Musician In The World 2020

- How Much Does Charli D'amelio Make A Tiktok Video

- How Much Net Worth Is Charli D'amelio

- Who Is The Richest Royalty

- How Much Is Kelly Clarkson Worth 2021

- Who Is The Richest Musician In Zambian 2020

- Lipton Sweetened Iced Tea Mix

- What Is Fred Durst Net Worth

- How Much Is 40000 Delta Skymiles Worth

- How Much Is A Kobe Bryant Upper Deck Rookie Card W...

- How Much Are My Miles Worth American Airlines

- Denise Cadel Kekayaan

- Charli D'amelio Net Worth June 2020

- How Much Is Royalty Soaps Worth

- How Rich Is Charlie Damelio

- Who Is The Richest Musician In Zambia Top 20

- Best Iced Tea Lemonade Recipe

- Who Is The Wealthiest Nba Player Ever

- What To Mix With Peach Tea Whiskey

- Who Is The Richest Female Musician In Nigeria 2020

- What Is Charlie Sheen Net Worth

- How Much Is A Capital One Venture Miles Worth

- How Much Is 50000 Capital One Miles Worth

- Starbucks Iced Green Tea Sugar

- Charlie Harper House Plans

- Is Lipton Pure Green Tea Caffeine Free

- How Do You Make Tea With Fresh Mint

- Ice T Hip Hop

- Carey Price Net Worth 2021

- Who Is The Richest Nfl Player Of All Time

- Who Is The Richest American Football Player Ever

- Denise Cadel Chinese

- How Long Has Ice T Been Married To Coco

- How Much Is 5000 Skywards Miles Worth

- How Much Are Capital One Miles Worth On Amazon

- Nick Best Net Worth 2020

- How Much Is Mike Brown Of The Bengals Worth

- Charli Damelio Age Now

- Iced Green Tea With Lemon

- How Much Is Fred Durst Worth

- What Is The Best Long Island Iced Tea Recipe

- Ice-t Commercial

- How Do You Make Thai Iced Tea From Scratch

-

▼

Juni

(350)